Stalled growth and trade risks keep BoC on sidelines

‘The Canadian economy is adjusting to the structural headwinds of U.S. protectionism,’ said Bank of Canada Governor Tiff Macklem, right, pictured with Senior Deputy Governor Carolyn Rogers at a press conference announcing a hold in the bank’s interest rate on Jan. 28. / SCREENSHOT

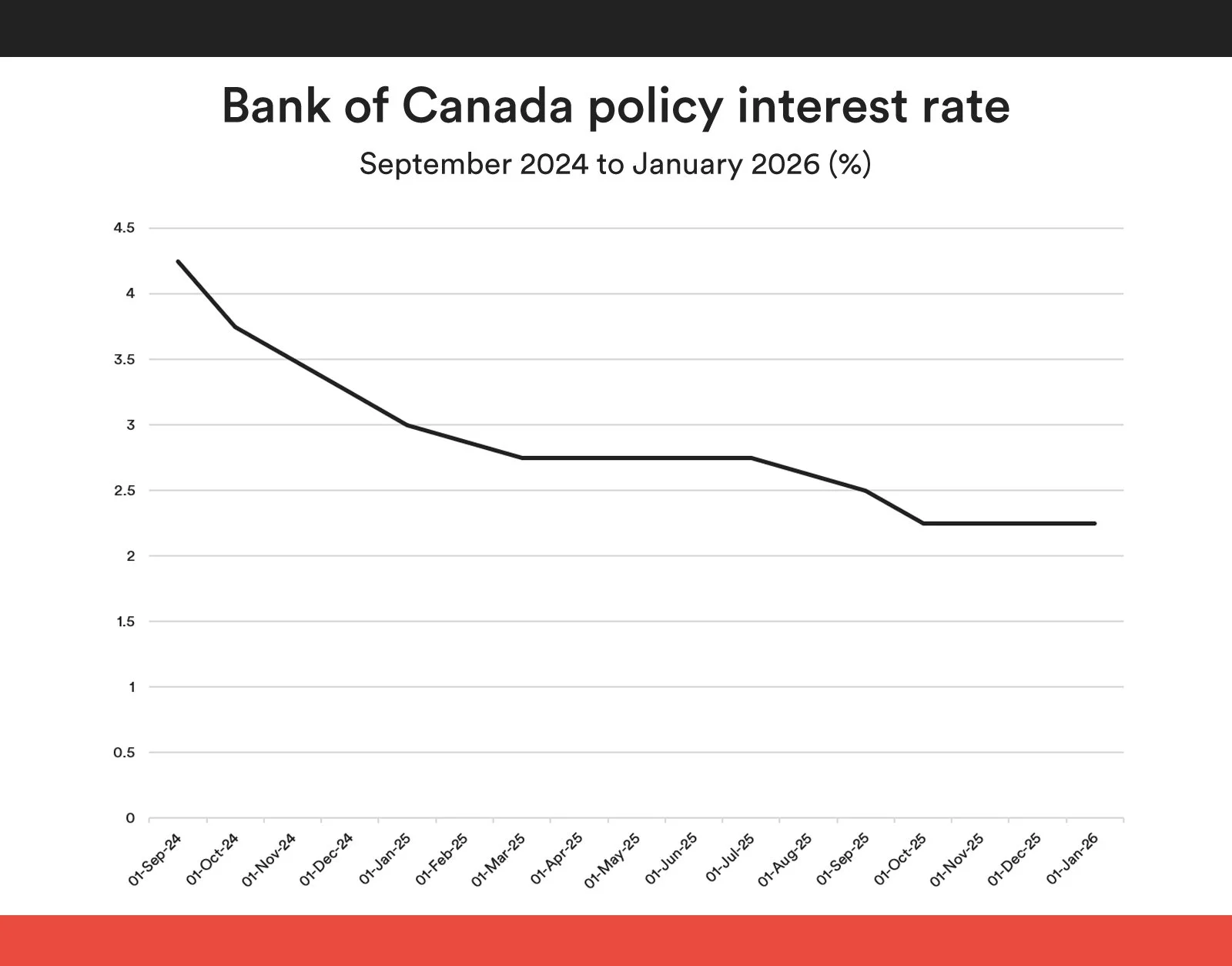

The Bank of Canada kept its key interest rate unchanged at 2.25% on Wednesday, a widely expected move that reinforces expectations policymakers will stay sidelined well into 2026.

“The Bank of Canada remains quite comfortable with where policy rates are for the time being," said BMO Chief Economist Doug Porter.

Governor Tiff Macklem’s tone in presenting the statement and updated forecasts “provided few surprises,” Porter said, with the Bank of Canada signalling “the outlook is too uncertain to seriously revise the economic view and/or to give much guidance on when and where rates are going next.”

Porter said there is “really nothing here to shift the call that the Bank will be on hold for the rest of 2026,” noting that “if there is a move, it's much more likely to be a rate cut rather than a hike this year.”

Several factors will limit the need for further easing

RBC economist Claire Fan struck a similar tone. Fan said the decision marked “the BoC's second consecutive hold after the December meeting,” with “stabilizing labour conditions, building fiscal support, and moderating inflation pressures toward the end of 2025 limiting the need for further easing.” Looking ahead, she said, “we and the BoC expect these trends to persist.”

In his opening statement, Macklem said the economy continues to adjust to U.S. trade restrictions, with “GDP to grow modestly and inflation to stay close to the 2% target.”

However, the Bank warned that “uncertainty around our forecast is heightened, and the range of possible outcomes is wider than usual,” citing unpredictable U.S. trade policy and elevated geopolitical risks.

“Tariffs and uncertainty continue to disrupt the Canadian economy,” Macklem said. “After a strong third quarter, economic growth likely stalled in the fourth quarter. Exports continue to be buffeted by US tariffs, while domestic demand appears to be picking up. U.S. tariffs and related uncertainty have held back business investment. But we expect some modest strengthening in investment as businesses adjust to the new trade environment and governments increase infrastructure spending.”

The bank estimates Q4 growth stalled and projects annual average GDP growth of 1.1% in 2026 and 1.5% in 2027. Porter noted the Bank is “much more cautious on 2027,” even as it assumes an agreement will be reached on the Canada-United States-Mexico Agreement.

Fan said the new Monetary Policy Report also points to “weaker growth in 2026 and 2027,” with GDP projections “left unchanged at softer levels of 1.1% and 1.5%.” She added that the Bank’s estimate of economic slack was “largely unchanged,” as stronger past growth was absorbed into higher potential output.

Uncertainty expected to weigh on business investment

Looking ahead, Fan said potential growth is expected to soften, “weighed by slower population assumptions and reduced business investment dampened by uncertainty,” with potential output growth slowing “to around 1% over 2026 and 2027.”

Macklem said it remains unclear how smoothly Canada will adapt to tariffs and ongoing uncertainty. The adjustment could be easier than expected if business and household spending strengthens, but there is also a risk of a weaker labour market, softer consumer spending, and tighter financial conditions.

“The Canadian economy is adjusting to the structural headwinds of U.S. protectionism. Businesses are reconfiguring supply chains and investing in new markets. We also expect to see some reallocation of capital and workers as new opportunities open up. This restructuring, including more diversified trade and a more integrated internal market, will support some recovery in our productive capacity. But it will all take some time.”