CPI report gives BoC ‘another reason’ to move to sidelines

UNSPLASH PHOTO

Inflation fell slightly in October, moving closer to the Bank of Canada’s 2% target, but “the details were a tad on the disappointing side,” says BMO chief economist Douglas Porter.

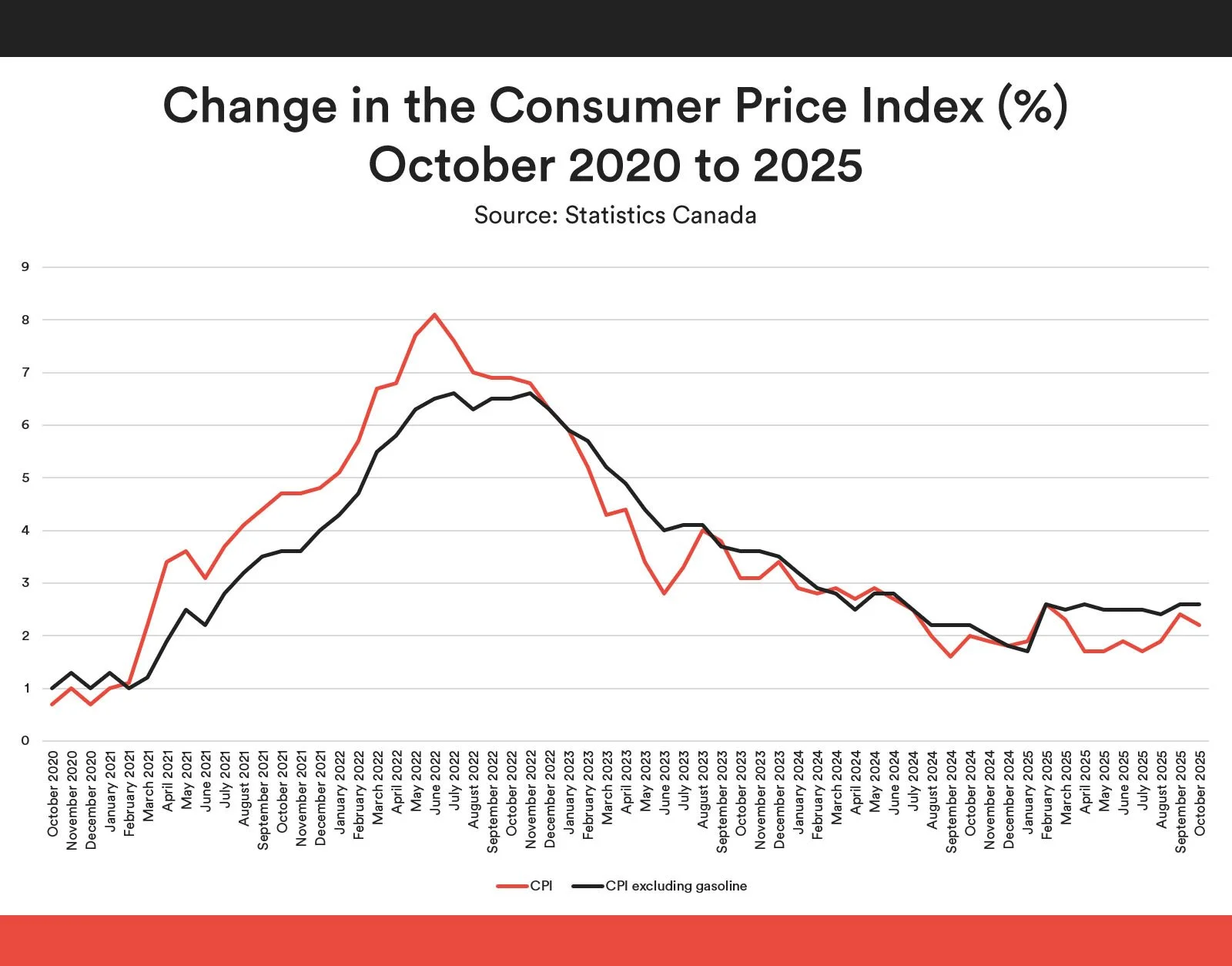

Prices rose 2.2% year-over-year, down from 2.4% in September, with cheaper energy prices doing most of the work to bring headline inflation lower, Statistics Canada said Monday.

Grocery prices rose 3.4% last month, down from a 4% pace in September, helped by cheaper processed foods and a drop in fresh vegetable prices. Grocery prices fell 0.6% on the month, the biggest decline in five years, though prices remain elevated, the agency said.

Outside of the food and energy categories, prices increased, suggesting firmer inflation in more stable parts of the economy.

“On the surface, this looks to be a mildly friendly report with headline and median inflation rates dipping,” Porter, chief economist at BMO, wrote in a note. However, he highlighted “persistent strength” in insurance costs and a jump in cell phone charges. “This report is just another reason to believe the Bank is moving to the sidelines in December.”

Cellphone plan prices went up 7.7% from a year ago, home insurance rose 6.8% and auto insurance 7.3%. Since October 2020, prices for homeowners' home and mortgage insurance rose almost 40% nationally, while prices for passenger vehicle insurance premiums rose 19%, Statistics Canada said.

The Bank of Canada cut its policy rate 25 basis points to 2.25% in October, and a hold is widely expected at the next meeting on Dec. 10.

RBC economist Abbey Xu said the data “aligns broadly” with the bank’s baseline scenario. “Core price pressures remain sticky at rates above the BoC's inflation target, consumer demand has proven resilient to-date despite international trade uncertainty, and fiscal policy is set to provide support to growth in the year ahead,” she said.

Xu doesn’t expect the central bank to reduce borrowing costs further, given policy makers have indicated the rate is at about the right level, provided inflation and economic activity continue following their October projections.